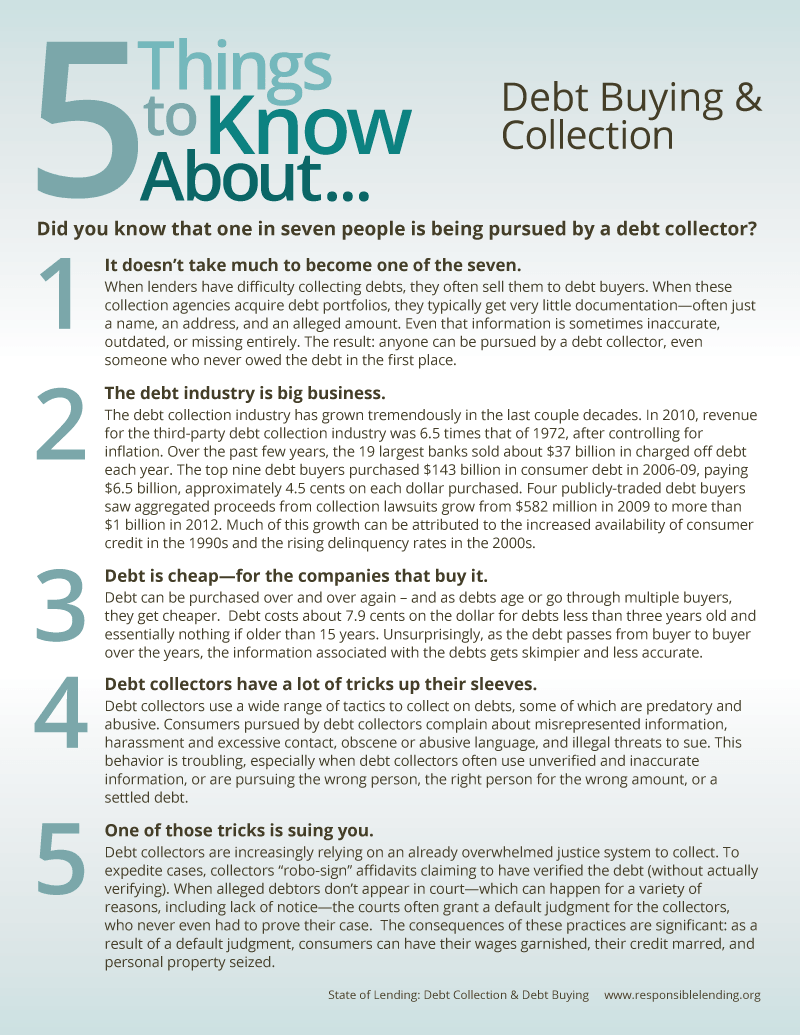

According to the Federal Reserve, one in seven Americans is being contacted by a debt collector.

This is up from one in twelve just ten years ago. With 4,500 debt

collection agencies in the United States, people find it hard to keep

track of who is collecting which debt. Debts are bought and sold so many

times that in the bankruptcy schedules we prepare we often list

multiple debt collection agencies for one debt just to try to make sure

we've hit upon the current owner. Between 2006-2009 the top nine debt

buyers purchased 90 million accounts to collect. While most of the debt

sold is credit card accounts, other debts like medical bills and

utilities are increasingly bought and sold. Experts believe other debts

such as cell phone bills, auto loan deficiencies and student loans will

be increasingly part of a debt buyer's portfolio.

This frequent buying and selling of debt creates other problems for legitimate debt collection too. For example, old debt is usually sold for pennies on the dollar and at such low prices original creditors have no incentive to try to provide the debt buyer with any loan documents like credit applications or account statements. As a result, debtors can be sued by a debt buyer with none of the evidence that would typically be required to prove that the agency suing is actually the owner of the debt. Debt collection agencies have also been known to use false affidavits, sue the wrong person, sue on debt beyond the statute of limitations, sue on debt discharged in bankruptcy and sue on debt that's already been paid. In some cases debt buyers just find people with the same or a similar name to sue, regardless of whether the person is actually the one who incurred the debt. In other cases, employees of the debt buyers engage in "robo-signing" of affidavits where they machine stamp their name to thousands of affidavits in a single day, despite the requirement that the affidavit be signed only after the person has personally reviewed and verified the accuracy of the the information. And since the defendants in nearly all debt collection lawsuits don't do anything to challenge the legitimacy of the claims, debt collectors are winning record numbers of lawsuits, resulting in garnishment of wages and bank accounts. If you live in Polk County and are facing debt collection we are willing to discuss defending these debt collection lawsuits on a flat fee basis. Contact us immediately after a debt collection agency contacts you so we can discuss your options. |

||

|

.

|

Tuesday, May 27, 2014

IS THIS DEBT YOURS?

Subscribe to:

Comments (Atom)